What Is A Good D&b Failure Score

DB considers any score of 70 or above to be good but 80 is ideal as it represents prompt payment. For instance a global organisation that is not likely to fail in the next.

This score is known as the Delinquency Score in the new DB Credit platform.

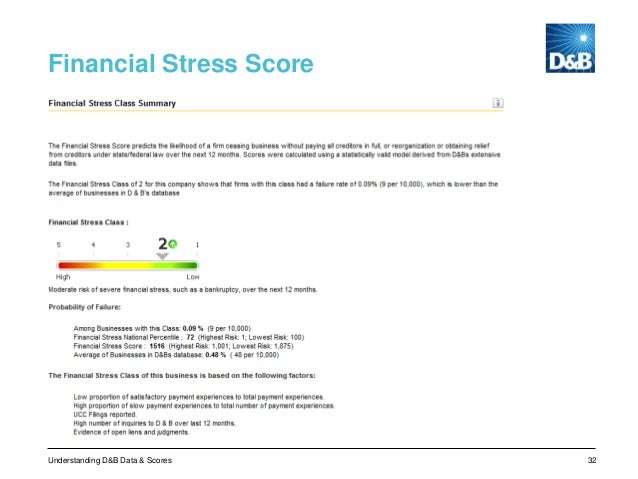

What is a good d&b failure score. The most creditworthy businesses have a score of 1. The highest score you can get if you dont submit financial information on your business to DB is a 2 so if you think a lender is going to use your DB report to evaluate a loan application it could be worthwhile to submit a financial statement to DB. A Score of 1001 1875 where a 1001 represents businesses that have the highest probability of financial stress and a 1875 which represents businesses with the lowest probability of financial stress.

It can often be the case that a companys Delinquency Score is very different to its Failure Score. The Failure Score is a multidimensional score comprising three components. A company that doesnt give financial information to DB cant have a score.

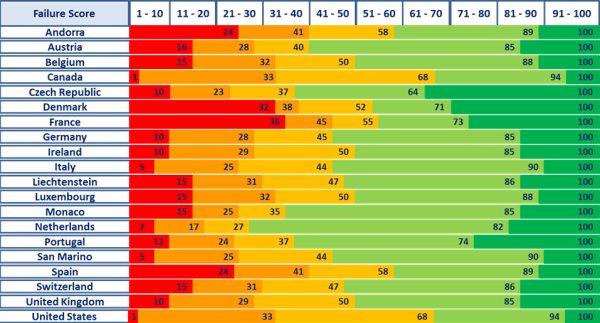

Like the DB Delinquency Predictor Score the risk information is classified in three ways from the broadest the class to the. The score is set with the lowest value representing the highest level of risk that a business will fail in the next 12 months. The score ranges from 1 to 100 with higher scores indicating a lower probability of delinquency.

The DB Failure Score predicts the likelihood that an organisation will obtain legal relief from its creditors or cease operations over the next 12 month period. Both businesses and creditors are more willing to engage with others who have a proven record of paying on time. The Failure Score is a multidimensional score comprised of two components.

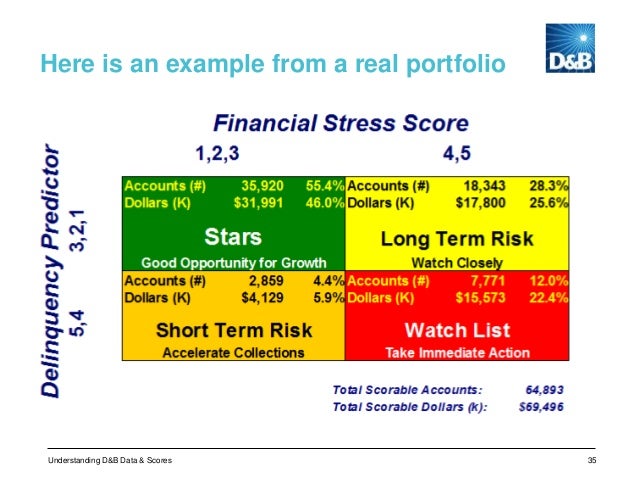

2097000 were considered good or financially and operational stable companies in the DB Supplier Risk Manager database and 8000 were considered bad or financially and operationally stressed companies in the DB database. The Sequential Organ Failure Assessment SOFA score is a scoring system that assesses the performance of several organ systems in the body neurologic blood liver kidney and blood pressurehemodynamics and assigns a score based on the data obtained in each category. The DB Delinquency Predictor Score is further broken down into five classes Class 1 reflects a Low Risk of late payment and Class 5 reflects a High Risk of late payment.

DB Delinquency Predictor Score DPS and DB Failure Score. Manage My Business Credit. Failure Scores range from 1-100 where 1 represents the highest risk of failure and 100 represents the lowest risk and can assist in creating a rank order of your.

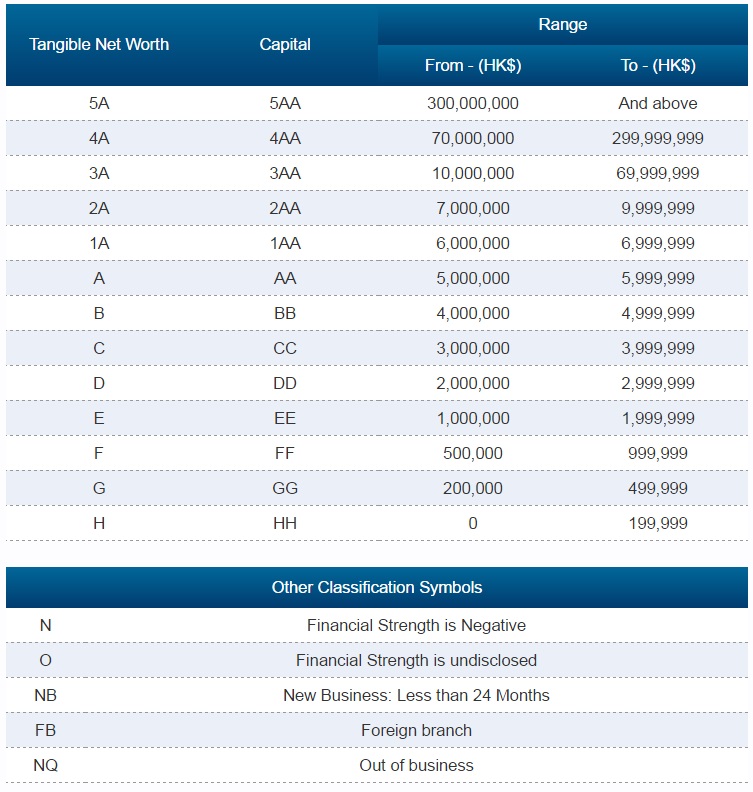

Customers with the standard account receive a DB PAYDEX letter grade and premium customers can see their DB Rating and exact PAYDEX score. The DB Failure Score predicts the likelihood that an organisation will fail with outstanding creditors in the next 12 months. In the example above the DB Rating indicates an organisation with Tangible Net Worth between 1500000 and 6999999 and a high risk of failure.

Having a good PAYDEX score could help you win new business and contracts. Higher scores can also get you better terms. Submit good payment history to DB to help impact your DB scores CreditMonitor.

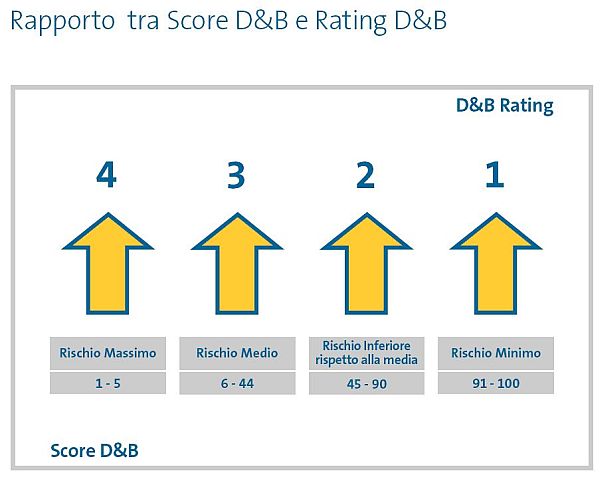

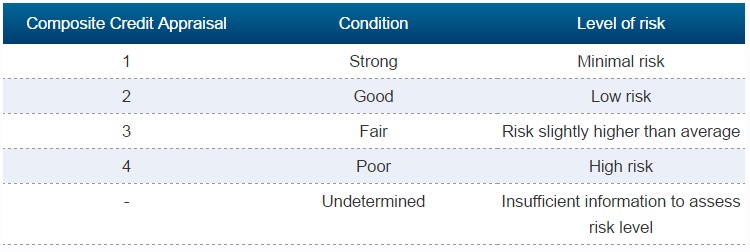

The PAYDEX score is a business credit score thats generated by Dun and Bradstreet DB. Monitor your credit file in real time with detailed info about changes to your DB scores CreditSignal. A score of 1 100 and a Risk Indicator of 1 4.

The higher the score the lower is the risk. The DB Predictor Score ranges from 101-670. The 4 classes of the Risk Indicator allow you to set cut-offs for decisions based on your companys credit policy and risk tolerance.

Open a Business Credit File. Get a dedicated Credibility Concierge for. Receive free alerts to changes to the scores and ratings in your DB business credit file Credibility Concierge.

What is a DB Failure Score. Risk Indicator - Derived from the D. UCC Filings and Business Credit Scores.

It ranges from 1 to 4. Both these ratings rely on a 1-out-of-5 rating system where 1 is the lowest likelihood and. This score provides a direct relationship between the score and the level of risk.

A percentile of 1 to 100 a class of 1 to 5 and the score itself which ranges from 1001 to 1875 with the lowest score representing the highest level of risk that a business will fail in the next 12 months. A businesss DB Rating and DB PAYDEX score are also available through Nav. The Failure scorecard also looks for events signalling the onset of failure such as a meeting of creditors administrator appointed bankruptcy receiver appointed and petition for winding-up.

Vendors that Will Help You Build Business Credit. This score is based on a companys payment history years in business public records number of employees and financial information. Their model analyzes a business payment performance ie if it pays its bills on time and gives it a numerical score from 1 to 100 with 100 signifying a perfect payment history.

The fact that they may pay your bill late does not necessarily mean they may go out of business in the next 12 months.

D B Delinquency Predictor Score

D B Delinquency Predictor Score

Comparing Different Business Credit Scores Tillful

Complete Guide To Building Business Credit Scores 2021

Business Credit Scores Ultimate Guide

Appendix B D B Rating Score Explanations Pdf Free Download

Https Www Eoecph Nhs Uk Files Sid4gov Guide To Dbs Predictive 20indicators Pdf

Https Www Eoecph Nhs Uk Files Sid4gov Guide To Dbs Predictive 20indicators Pdf

D B Global Decisionmaker User Guide

Dun Bradstreet Pipeline Risk Analysis Gz Consulting

Appendix B D B Rating Score Explanations Pdf Free Download

The Hidden Gems Optimizing Your Dnb Credit Reports

Business Credit Scores Ultimate Guide

Sati Is Awarded The D B Rating 1 Sati Spa

Post a Comment for "What Is A Good D&b Failure Score"