Volume Spread Analysis Rules

Volume Spread Analysis Rules and Principles at Work. But it sounds like a convoluted trading method with uncommon terms like No Demand Bar and Stopping Volume.

Volume Spread Analysis In Trading Price Action Analysis

Supply when it comes it comes on an up candle.

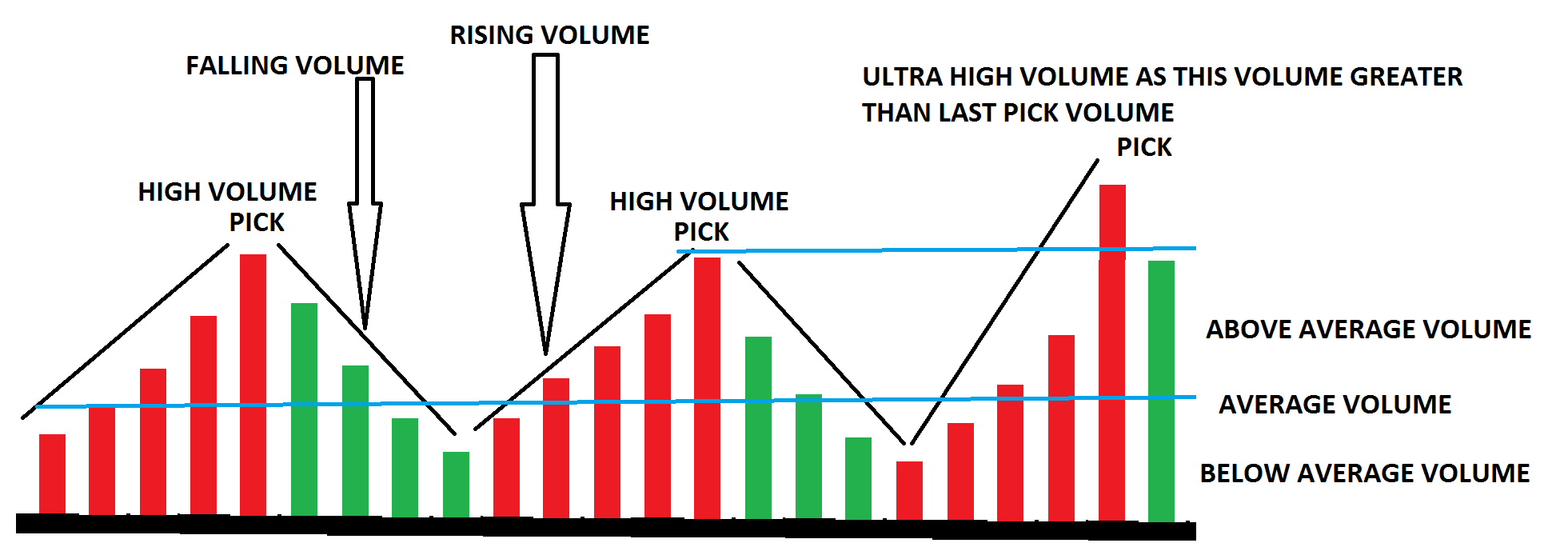

Volume spread analysis rules. -1 V_OPEN V_CLOSE1 V_CLOSE closevolumex V_HIGH maxmaxhighvolumexV_CLOSEV_OPEN V_LOW. Volume Spread Analysis Rules combine the major factors that help recognise either an increase in Demand or an increase in Supply which is used to estimate the future price trend. Technical Analysis is not just analysis of price movements it is not just analysis of moving averages.

Version2 studyVolume Spread Analysis shorttitleVSA Volume Spread Analysis Analisis de propagacion en Volumen devicemxl -- TradingView Site volumexvolumecloseclose1. Volume is also the earliest indicator of the beginning of a specific trend. Normalize volume and price range for 10 to 30 bars such that average change in volume is the same as average.

Twitter handle hariprasath_93Join our telegram channel - httpstmevolumeprofiletradesecretsVolume spread analysis is a powerful concept developed by Tom. If only five transactions occur in. Volume counts shares or contracts traded in a security or in an entire market.

Volume Spread Analysis look into volume spread and close. Rule Number 1- Weakness appears on an Up candle. Today was another strong day in the market and this afternoon I witnessed and traded one of the best examples of volume spread analysis rules and principles that Ive seen take place in the market.

He is a Syndicate trader who knows well about how smart moneys are playing their role. Probably considered as the father of Volume spread analysis. This tries to analyze.

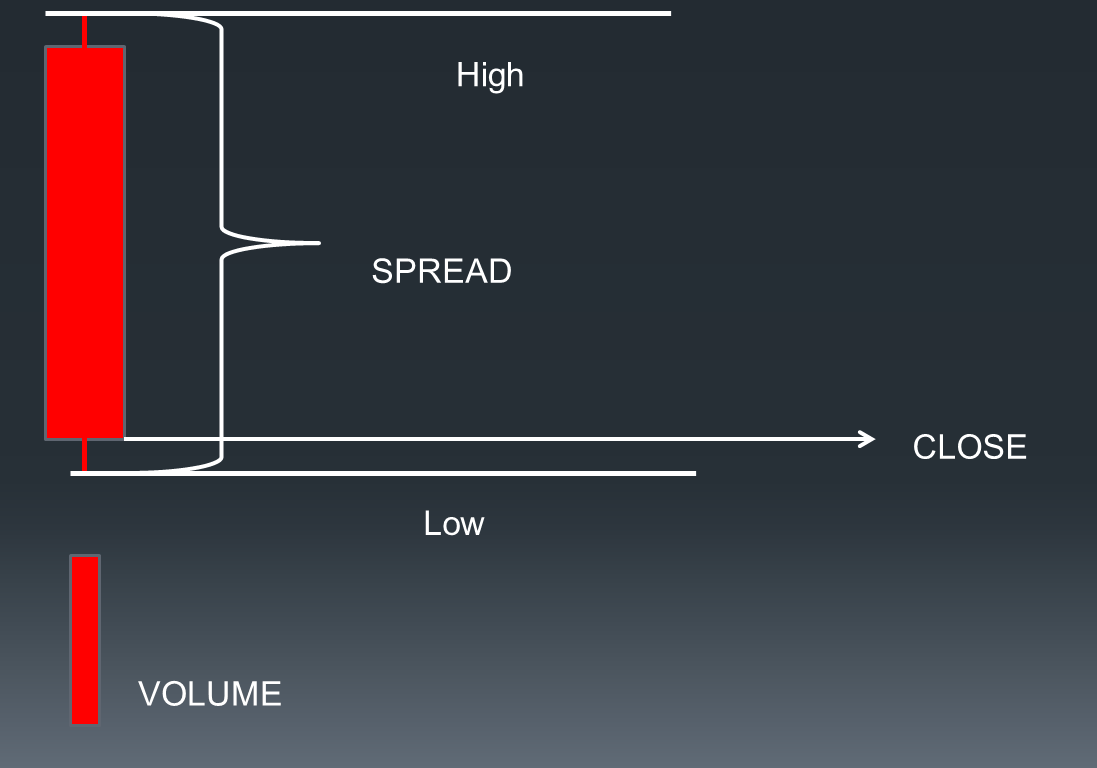

Range Dispersion or difference between the maximum and the closing do not confuse with the bid ask spread. We in FIG strongly believe that we cannot beat or out perform institutional traders instead. Volume spread analysis is a very powerful tool developed by Tom Williams.

It should be less than the previous candle. Scan for confirmation signals in up to 10 time frames. This is an exact definition of technical analysis.

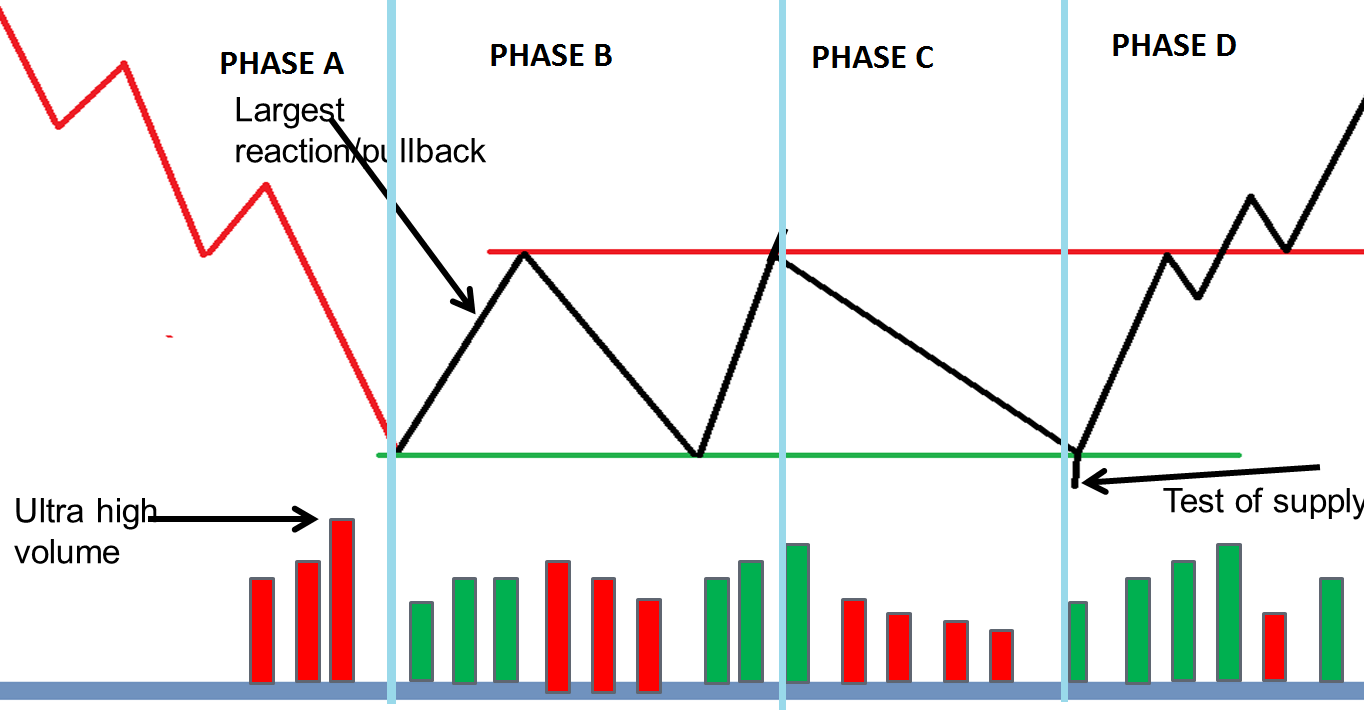

Some volume spread analysis that suggests the end of down trend. Candle spreads should be narrow. One transaction is an agreement between buyers and sellers at a certain price.

Volume Spread Analysis is a study focused on the analysis of volume and price data to see the distribution of Supply and Demand. Scan medium term trend in up to 10 time frames. Volume Spread Analysis uses price and volume current and past data to predict the most possible future trend development.

Your First Guide to Volume Spread Analysis VSA By Galen Woods in Trading Articles on October 21 2014. Closes can be on the highs but better when in the middle or near the high. In some sources you may find statement that Volume Spread Analysis neither fundamental nor technical analysis.

Demand when it comes it comes on a down candle. Range closing price is the closing price close to the top or bottom of the bar. Scan up to 25 markets simultaneously.

Scan volume thermometer in multiple time frames. Price changes can only be confirmed with the help of volume. Posted on August 4 2010 by admin.

Provide audible alert for change in trend. Closing price is higher than opening price for the current bar. For every buyer there is a seller.

Volume Spread Analysis Rules. We will also keep in mind the general background of the market. In the event of a higher volume the spread of the day or other timeframe such as a spread of a five minute candle should remain low.

Now we have found two important rules for volume spread analysis. A successful low volume test tells you that the market is ready to rise. Is VSA really that inaccessible.

Volume is weaker on average than past two days. Volume Spread Analysis also known as VSA is a tool to study the relationship of price and volume looking to predict the short-term direction of the market. Current Rules for VSA 1 1.

I have developed an Indicator with Trading View called Volume spread analysis. What was surely a choppy and confusing afternoon to. Volume Spread Analysis No demand on up bar.

Traded volumes should be higher at the top of the congestion area and lower at the bottom of the congestion area. In the char below you can see an example of this setup on the Apple daily chart. Rule Number 2- Strength Appears on a Down candle.

A down bar on reduced volume and narrow spread. The key is the volume. You have heard of Volume Spread Analysis and the value it might add to your analysis.

Each transaction contributes to the count of the Total Volume. Total volume should be very low. Checklist The best entrances within a trend is when we see a no supply within an uptrend or a no demand within a downtrend.

This is not correct. Volume Spread Analysis Short opportunity when.

Volume Spread Analysis In Trading Price Action Analysis

Download Free Pvsra Price Volume S R Analysis Forex Smart Money Trading Strategies

Accumulation Distribution Technical Analysis Price Divergences Trading Charts Online Stock Trading Technical Analysis Indicators

Volume Spread Analysis In Trading Price Action Analysis

Volume Spread Analysis In Trading Price Action Analysis

Volume Spread Analysis In Trading Price Action Analysis

Volume Spread Analysis In Trading Price Action Analysis

Vsa Trading Strategy In Detail Youtube

Upthrust Bar Volume Price Analysis

Wyckoff Formation Only Forex Factory

Forexexperts Net Richard Wyckoff Volume Spread Analysis

Volume Spread Analysis In Trading Price Action Analysis

:max_bytes(150000):strip_icc()/PlayingtheGap22-b74a16eb4de4467da30401c685653ef8.png)

Post a Comment for "Volume Spread Analysis Rules"